Calcul XIRR

Comment puis-je calculer Excel XIRR fonction utilisant C#?

4 réponses

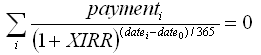

Selon fonction XIRR documentation openoffice (la formule est la même que dans excel) vous devez résoudre pour la variable XIRR dans les f (xirr) équation:

vous pouvez calculer la valeur xirr par:

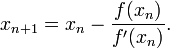

- calcul de la dérivée de la fonction ci-dessus -> f '(xirr)

- après avoir

f(xirr)etf'(xirr)vous pouvez résoudre pour la valeur xirr en utilisant itératif Newton méthode - formule célèbre->

EDIT

J'ai un peu de temps donc, voici - code C complet pour le calcul XIRR:

class xirr

{

public const double tol = 0.001;

public delegate double fx(double x);

public static fx composeFunctions(fx f1, fx f2) {

return (double x) => f1(x) + f2(x);

}

public static fx f_xirr(double p, double dt, double dt0) {

return (double x) => p*Math.Pow((1.0+x),((dt0-dt)/365.0));

}

public static fx df_xirr(double p, double dt, double dt0) {

return (double x) => (1.0/365.0)*(dt0-dt)*p*Math.Pow((x+1.0),(((dt0-dt)/365.0)-1.0));

}

public static fx total_f_xirr(double[] payments, double[] days) {

fx resf = (double x) => 0.0;

for (int i = 0; i < payments.Length; i++) {

resf = composeFunctions(resf,f_xirr(payments[i],days[i],days[0]));

}

return resf;

}

public static fx total_df_xirr(double[] payments, double[] days) {

fx resf = (double x) => 0.0;

for (int i = 0; i < payments.Length; i++) {

resf = composeFunctions(resf,df_xirr(payments[i],days[i],days[0]));

}

return resf;

}

public static double Newtons_method(double guess, fx f, fx df) {

double x0 = guess;

double x1 = 0.0;

double err = 1e+100;

while (err > tol) {

x1 = x0 - f(x0)/df(x0);

err = Math.Abs(x1-x0);

x0 = x1;

}

return x0;

}

public static void Main (string[] args)

{

double[] payments = {-6800,1000,2000,4000}; // payments

double[] days = {01,08,16,25}; // days of payment (as day of year)

double xirr = Newtons_method(0.1,

total_f_xirr(payments,days),

total_df_xirr(payments,days));

Console.WriteLine("XIRR value is {0}", xirr);

}

}

BTW, gardez à l'esprit que tous les paiements auront pour résultat valide XIRR en raison de restrictions de la formule et/ou de la méthode de Newton!

cheers!

j'ai commencé avec 0x69's solution mais par la suite, des nouveaux scénarios causé la Méthode de Newton à l'échec. J'ai créé une version "intelligente", qui utilise la méthode de Bisection (plus lente) lorsque Newton échoue.

Veuillez noter que la ligne des références à de multiples sources que j'ai utilisé pour cette solution.

Enfin, vous n'allez pas être en mesure de reproduire certains de ces scénarios dans Excel, Excel lui-même utilise la méthode de Newton. Reportez-vous à XIRR, hein? pour un discussion intéressante à ce sujet.

using System; using System.Collections.Generic; using System.Linq;// See the following articles: // http://blogs.msdn.com/b/lucabol/archive/2007/12/17/bisection-based-xirr-implementation-in-c.aspx // http://www.codeproject.com/Articles/79541/Three-Methods-for-Root-finding-in-C // http://www.financialwebring.org/forum/viewtopic.php?t=105243&highlight=xirr // Default values based on Excel doc // http://office.microsoft.com/en-us/excel-help/xirr-function-HP010062387.aspx

namespace Xirr { public class Program { private const Double DaysPerYear = 365.0; private const int MaxIterations = 100; private const double DefaultTolerance = 1E-6; private const double DefaultGuess = 0.1;

private static readonly Func<IEnumerable<CashItem>, Double> NewthonsMethod = cf => NewtonsMethodImplementation(cf, Xnpv, XnpvPrime); private static readonly Func<IEnumerable<CashItem>, Double> BisectionMethod = cf => BisectionMethodImplementation(cf, Xnpv); public static void Main(string[] args) { RunScenario(new[] { // this scenario fails with Newton's but succeeds with slower Bisection new CashItem(new DateTime(2012, 6, 1), 0.01), new CashItem(new DateTime(2012, 7, 23), 3042626.18), new CashItem(new DateTime(2012, 11, 7), -491356.62), new CashItem(new DateTime(2012, 11, 30), 631579.92), new CashItem(new DateTime(2012, 12, 1), 19769.5), new CashItem(new DateTime(2013, 1, 16), 1551771.47), new CashItem(new DateTime(2013, 2, 8), -304595), new CashItem(new DateTime(2013, 3, 26), 3880609.64), new CashItem(new DateTime(2013, 3, 31), -4331949.61) }); RunScenario(new[] { new CashItem(new DateTime(2001, 5, 1), 10000), new CashItem(new DateTime(2002, 3, 1), 2000), new CashItem(new DateTime(2002, 5, 1), -5500), new CashItem(new DateTime(2002, 9, 1), 3000), new CashItem(new DateTime(2003, 2, 1), 3500), new CashItem(new DateTime(2003, 5, 1), -15000) }); } private static void RunScenario(IEnumerable<CashItem> cashFlow) { try { try { var result = CalcXirr(cashFlow, NewthonsMethod); Console.WriteLine("XIRR [Newton's] value is {0}", result); } catch (InvalidOperationException) { // Failed: try another algorithm var result = CalcXirr(cashFlow, BisectionMethod); Console.WriteLine("XIRR [Bisection] (Newton's failed) value is {0}", result); } } catch (ArgumentException e) { Console.WriteLine(e.Message); } catch (InvalidOperationException exception) { Console.WriteLine(exception.Message); } } private static double CalcXirr(IEnumerable<CashItem> cashFlow, Func<IEnumerable<CashItem>, double> method) { if (cashFlow.Count(cf => cf.Amount > 0) == 0) throw new ArgumentException("Add at least one positive item"); if (cashFlow.Count(c => c.Amount < 0) == 0) throw new ArgumentException("Add at least one negative item"); var result = method(cashFlow); if (Double.IsInfinity(result)) throw new InvalidOperationException("Could not calculate: Infinity"); if (Double.IsNaN(result)) throw new InvalidOperationException("Could not calculate: Not a number"); return result; } private static Double NewtonsMethodImplementation(IEnumerable<CashItem> cashFlow, Func<IEnumerable<CashItem>, Double, Double> f, Func<IEnumerable<CashItem>, Double, Double> df, Double guess = DefaultGuess, Double tolerance = DefaultTolerance, int maxIterations = MaxIterations) { var x0 = guess; var i = 0; Double error; do { var dfx0 = df(cashFlow, x0); if (Math.Abs(dfx0 - 0) < Double.Epsilon) throw new InvalidOperationException("Could not calculate: No solution found. df(x) = 0"); var fx0 = f(cashFlow, x0); var x1 = x0 - fx0/dfx0; error = Math.Abs(x1 - x0); x0 = x1; } while (error > tolerance && ++i < maxIterations); if (i == maxIterations) throw new InvalidOperationException("Could not calculate: No solution found. Max iterations reached."); return x0; } internal static Double BisectionMethodImplementation(IEnumerable<CashItem> cashFlow, Func<IEnumerable<CashItem>, Double, Double> f, Double tolerance = DefaultTolerance, int maxIterations = MaxIterations) { // From "Applied Numerical Analysis" by Gerald var brackets = Brackets.Find(Xnpv, cashFlow); if (Math.Abs(brackets.First - brackets.Second) < Double.Epsilon) throw new ArgumentException("Could not calculate: bracket failed"); Double f3; Double result; var x1 = brackets.First; var x2 = brackets.Second; var i = 0; do { var f1 = f(cashFlow, x1); var f2 = f(cashFlow, x2); if (Math.Abs(f1) < Double.Epsilon && Math.Abs(f2) < Double.Epsilon) throw new InvalidOperationException("Could not calculate: No solution found"); if (f1*f2 > 0) throw new ArgumentException("Could not calculate: bracket failed for x1, x2"); result = (x1 + x2)/2; f3 = f(cashFlow, result); if (f3*f1 < 0) x2 = result; else x1 = result; } while (Math.Abs(x1 - x2)/2 > tolerance && Math.Abs(f3) > Double.Epsilon && ++i < maxIterations); if (i == maxIterations) throw new InvalidOperationException("Could not calculate: No solution found"); return result; } private static Double Xnpv(IEnumerable<CashItem> cashFlow, Double rate) { if (rate <= -1) rate = -1 + 1E-10; // Very funky ... Better check what an IRR <= -100% means var startDate = cashFlow.OrderBy(i => i.Date).First().Date; return (from item in cashFlow let days = -(item.Date - startDate).Days select item.Amount*Math.Pow(1 + rate, days/DaysPerYear)).Sum(); } private static Double XnpvPrime(IEnumerable<CashItem> cashFlow, Double rate) { var startDate = cashFlow.OrderBy(i => i.Date).First().Date; return (from item in cashFlow let daysRatio = -(item.Date - startDate).Days/DaysPerYear select item.Amount*daysRatio*Math.Pow(1.0 + rate, daysRatio - 1)).Sum(); } public struct Brackets { public readonly Double First; public readonly Double Second; public Brackets(Double first, Double second) { First = first; Second = second; } internal static Brackets Find(Func<IEnumerable<CashItem>, Double, Double> f, IEnumerable<CashItem> cashFlow, Double guess = DefaultGuess, int maxIterations = MaxIterations) { const Double bracketStep = 0.5; var leftBracket = guess - bracketStep; var rightBracket = guess + bracketStep; var i = 0; while (f(cashFlow, leftBracket)*f(cashFlow, rightBracket) > 0 && i++ < maxIterations) { leftBracket -= bracketStep; rightBracket += bracketStep; } return i >= maxIterations ? new Brackets(0, 0) : new Brackets(leftBracket, rightBracket); } } public struct CashItem { public DateTime Date; public Double Amount; public CashItem(DateTime date, Double amount) { Date = date; Amount = amount; } } }

}

Les autres réponses montrent comment œuvre XIRR en C#, mais si seulement le calcul résultat

ajouter D'abord une référence à Microsoft.Bureau.Interop.Excel, puis utilisez la méthode suivante: public static double Xirr(IList<double> values, IList<DateTime> dates)

{

var xlApp = new Application();

var datesAsDoubles = new List<double>();

foreach (var date in dates)

{

var totalDays = (date - DateTime.MinValue).TotalDays;

datesAsDoubles.Add(totalDays);

}

var valuesArray = values.ToArray();

var datesArray = datesAsDoubles.ToArray();

return xlApp.WorksheetFunction.Xirr(valuesArray, datesArray);

}

Merci aux contributeurs du paquet nuget situé à Excel Fonctions Financières. Il prend en charge de nombreuses méthodes financières - AccrInt, Irr, Npv, Pv, XIrr, XNpv, etc.,

- installer et importer le paquet.

- comme toutes les méthodes sont statiques dans la classe financière, appelez directement méthode spécifique comme

Financial.<method_name>paramètres requis.

Exemple:

using Excel.FinancialFunctions;

namespace ExcelXirr

{

class Program

{

static void Main(string[] args)

{

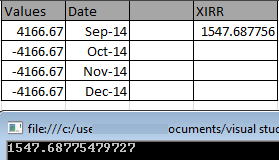

List<double> valList =new List<double>();

valList.Add(4166.67);

valList.Add(-4166.67);

valList.Add(-4166.67);

valList.Add(-4166.67);

List<DateTime> dtList = new List<DateTime>();

dtList.Add(new DateTime(2014, 9, 1));

dtList.Add(new DateTime(2014, 10, 1));

dtList.Add(new DateTime(2014, 11, 1));

dtList.Add(new DateTime(2014, 12, 1));

double result = Financial.XIrr(valList, dtList);

Console.WriteLine(result);

Console.ReadLine();

}

}

}

Résultat est le même que Excel.